You know things are bad when the Chairman of the Federal Reserve says something like "We don't have a precise read on why this slower pace of growth is persisting." as Bernanke said yesterday during his press conference. Clearly, given the plethora of negative economic data, we are well past the discussion of statistical anomalies and into the realm of "oh crap, how bad are things going to get?"

Today, we had two more negative datapoints. The weekly jobless claims number was, once again, worse than expected with 429,000 new claims filed, up 9,000 from the week before, which was revised up from 414,000 to 420,000 (it seems the revisions almost always go up, never down recently). Also, the Chicago Fed National Activity Index was released, again, missing expectations and pointing towards an economy double dipping. See the chart below, which shows the 3 month moving average for the statistic (the Chicago Fed recommends using a 3 month average as the monthly number tends to add a lot of noise).

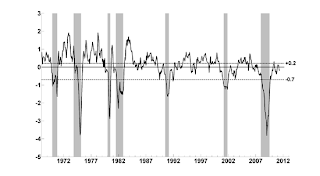

Currently, the 3 month moving average is at -0.19. A reading at -0.7 would indicate that there is a good chance we have entered a recession. Looking at the chart, it looks like we have a ways to go until we hit -0.7, but the March number was a positive 0.34, so once we get the June number and March drops out, our 3 month moving average will drop down to the -0.4 to -0.5 range, assuming June is like April and May. I'm sure many of you are asking "is there anything magical about -0.7?", nope just like any statistic, it is just that, a statistic. But based on the historical data, if after a period of economic recovery we start hitting -0.7 a recession often follows. See the chart below with recessionary periods in gray shading:

One last point I would like to make is that, looking at this chart, it's pretty clear that our current recession is the worst since 1974, when we had the President resign in disgrace, we retreated from Vietnam and had a arab oil embargo. What is also very clear is that our current recovery is nowhere near as robust as prior recoveries. The economy was a mess in the mid-1970's, but it was still able to bounce back nicely after 1974. In the current recovery, the 3 month moving average has only been positive for 6 months since Obama took office! The start of the recession was clearly not his fault (unless voting "present" takes away from manufacturing activity) but the failure of the recovery IS. If only he hadn't blown our wad on temporary infrastructure spending, perhaps he would have more weapons in his arsenal going forward.

No comments:

Post a Comment