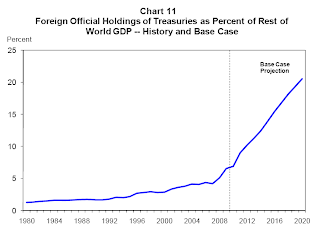

I just started reading After America by Mark Steyn which I highly recommend to anyone. It is probably the most humorous book on the economic apocalypse you'll ever read. Anyway, Mark Steyn refers to a paper called "Financing US Debt: Is There Enough Money in the World - and At What Cost?" by US Treasury official (and former Chief Economist of the Office of Management & Budget) John Kitchen and Menzie Chinn of the Robert M. La Follete School of Public Affairs at the University of Wisconsin. Using estimates from the CBO, they calculate how much US Treasury debt foreign governments will have to buy over the coming years to keep funding our government at current interest rates. The results are simply not pretty. It is becoming increasingly evident that the US debt is just so enormous that we will eventually not have enough people around to actually buy our debt from us. Check out this key chart:

As you can see, the way we are going, foreign ownership of US debt will have to be over 20% of non-US world GDP by 2020! The worst part about all this is that this figure was in the low single digits just a decade ago. We are headed for a crisis and soon, probably in the next four years (though exactly when is unknown as nobody knows which level will be the tipping point).

Don't believe me? I know one of my lefty friends likes to point out that things can't be so bad otherwise US debt wouldn't be trading at such a low yield right now. As if complacency amongst the masses is a good justification to be complacent yourself. I would just like to point out that Greek 10 year debt was trading at a 4.5% yield in August of 2009 and was trading at 29% just two and a half years later! When things stop working, they can stop working very very quickly.

There just simply isn't enough money out there. Just think about the graph above. In a given year, about 20% of our debt has to be refinanced, so at 20% of world GDP, that means that foreign governments will have to expend 4% of their GDP every year just for us to roll over our debt! Considering most governments account for 30-40% of GDP, we are talking about at least 10% of government budgets that would have to be allocated towards US Treasury purchases. Why exactly would they do something like that? Especially with such uber low interest rates on US debt?

The worst thing is that we are already seeing the largest foreign owner of our debt start to actually reduce their holdings. China, who we seem to assume will constantly be willing to buy our debt because our economies are so linked, has actually reduced its holdings of our debt by $115 billion in the last year, that's a 9% reduction in just one year. Without China providing incremental demand for our debt, where are we going to find additional buyers? Remember, most of the larger economies are also struggling to pay off their social safety net promises and don't have the excess cash to spend on us, not in any meaningful way.

Like it or not, we are likely to see a combination of these three policies in the next few years by our government to deal with the coming crisis:

1. Money printing from the Federal Reserve, which has pretty much already begun. In 2011, as part of QE2, the Federal Reserve bought a whopping 61% of US debt issuance in that year. Eventually Brazilian type hyperinflation will be rearing its ugly head. This will hurt the poor especially as they won't have any real property that will increase in value to counterbalance the across the board increase in expenses they will face.

2. Interest rates on our debt will simply have to increase to attract more investors. 1, 2 and 3% yields will be a thing of the past as those aren't even close to attractive returns on investment. Unfortunately, increasing yields will kill our real estate market (again) and balloon our deficit further as our interest expense burden will mushroom.

3. Severe austerity will be forced on us. If this austerity is tax heavy, expect it to kill the economy and not actually close the funding gap much, which is a phenomenon we've seen in Greece. Eventually, even entitlements will have to be cut, but the longer we wait the less help it will do and more pain it will cause.

Most people have been thinking the problem will only come to a head in 20-30 years. Based on the foreign holdings data, that crisis is coming very soon and unfortunately we have the very worst President possible to deal with that crisis.

No comments:

Post a Comment